Are you a retiree looking to enhance your financial stability? Or a homeowner seeking to make the most of your home equity without selling your property? This post is your ultimate guide to understanding reverse mortgages in Canada. By the end, you’ll learn how this financial tool can be a game-changer for retirement planning and financial security.

What is a Reverse Mortgage?

A reverse mortgage is a financial product designed for Canadian homeowners aged 55 and older. This type of loan allows you to unlock up to 55% of your home’s value without selling your property. Often referred to as “equity release,” a reverse mortgage provides access to your home equity, offering financial flexibility while you continue to live in your home.

How Does it Differ from a Traditional Mortgage?

Traditional mortgages require monthly payments to pay off the loan. Conversely, reverse mortgages don’t require you to make any payments as long as you live in the home. The loan is repaid when you sell the house, move out, or pass away. This makes reverse mortgages attractive for those looking to stay in their homes while tapping into their equity.

Understanding Reverse Mortgages in Canada

Eligibility Criteria and Requirements

To qualify for a reverse mortgage in Canada, you must be at least 55 and own your home. Both you and your spouse must meet the age requirement. Your home must be your primary residence, meaning you live there for at least six months of the year. This ensures the home is well-maintained and retains its value.

Types of Properties That Qualify

Most types of homes qualify for a reverse mortgage, including single-family homes, townhouses, and condos. However, the property must meet specific standards set by the lender. For example, it should be in good condition and in an area where property values are stable or increasing. Vacation homes and rental properties do not qualify.

Advantages and Disadvantages for Retirees and Homeowners

One significant advantage of a reverse mortgage is the ability to access your home equity without selling your home. This can provide much-needed cash flow in retirement. Additionally, the funds received are tax-free. However, reverse mortgages come with higher interest rates compared to traditional loans. They also reduce the equity in your home, affecting the amount you can leave to your heirs.

Impact on Inheritance and Financial Planning

It’s crucial to consider how a reverse mortgage will affect your estate. Since the loan balance increases over time, less equity may be left for your beneficiaries. Proper financial planning and consultation with a reverse mortgage agent can help mitigate these concerns. Ensure you weigh the benefits against the potential impact on your inheritance.

How to Apply for a Reverse Mortgage

Applying for a reverse mortgage involves several steps. First, consult a reverse mortgage agent to ensure this is your right choice. Next, contact a lender who offers reverse mortgages. They will evaluate your home and determine how much equity you can access. You must complete an application form and provide the necessary documentation, such as proof of age and ownership.

Financial Planning Considerations

Reverse Mortgages in Retirement Planning

A reverse mortgage can be a vital part of your retirement planning strategy. It offers an additional income stream, allowing you to preserve other retirement assets like RRSPs and pensions. It can enhance your overall financial stability and provide peace of mind when integrated correctly.

Potential Tax Implications

It’s essential to understand the tax implications associated with reverse mortgages. The good news is that the funds received are not considered taxable income. This means you can use the money without affecting your tax bracket. However, please consult a tax advisor to understand how it fits into your broader financial plan.

Understanding reverse mortgages allows you to make informed decisions that align with your financial goals and retirement plans. Explore your options today and secure a financially stable future.

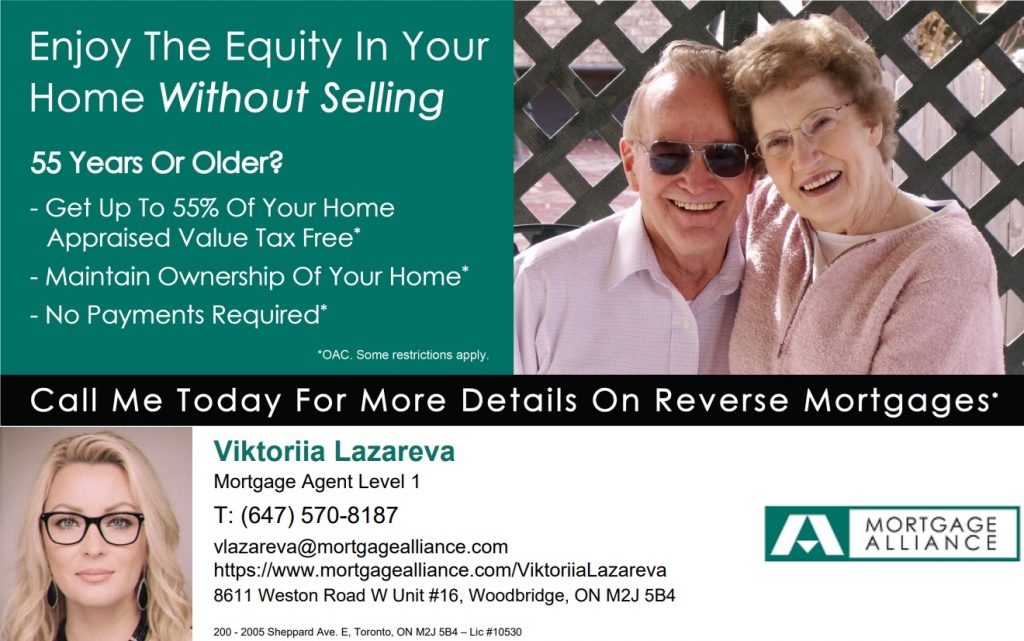

For more information on retirement financial planning and reverse mortgages in Canada, contact Viktoriia Lazareva, Mortgage Agent from Ontario, Canada

(647)570-8187

vlazareva@mortgagealliance.com

www.mortgagealliance.com/ViktoriiaLazareva